America’s energy security is at its strongest point in two decades, according to the latest edition of the Energy Institute’s Index of U.S. Energy Security Risk.

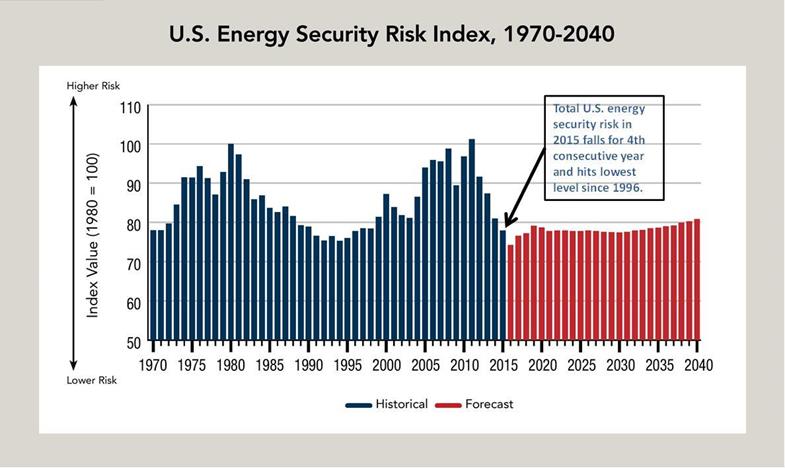

This 2016 edition of the Index, the seventh in the series, provides an updated look at U.S. energy security incorporating the most recent historical data and updated forecasts. The Index employs 37 different measures of energy security risk and covers the period from 1970 to 2040. Like a golf scorecard, a low Index score is better than a high Index score.

In 2015—the most recent year available-risk dropped 3 points, to 78.0, the lowest level since 1996. This is the fourth consecutive year that the overall U.S. risk score has declined. From a record high score of 101.2 points in 2011, it has fallen 23.2 points. Based on the most recent forecast from the Energy Information Administration, we also expect that future risks will be lower than thought compared to earlier forecasts. (See the chart nearby for all of the scores from 1970 to 2040.)

To explain this good news, one need look no further than the application of hydraulic fracturing, horizontal drilling, and advanced seismic imaging throughout the country’s vast shale formations. The rapid increase in domestic oil and natural gas production has lowered energy imports and expenditures for those imports and put downward pressure on prices. Despite slumping prices, domestic crude oil output still increased by more than seven percent in 2015, off the pace of previous years but still quite good. Natural gas production achieved a record high, with a five percent increase in 2015. Continued improvements in energy efficiency also have contributed to the lowering of energy security risks that we’ve seen over the past few years.

It’s not all good news, though. Crude oil price volatility rose significantly, driven by the desire of Saudi Arabia to capture greater market share by driving down sharply the price of crude oil. Rapid shifts in prices in either direction—volatility—can create unstable market conditions that increase energy security risks. One thing we’ve learned recently, however, is that America’s energy entrepreneurs are up to the challenge and will maintain high levels of output that should help keep prices from rising too much. As prices firm up, we can expect that U.S. producers will continue to do what they do best—innovate.

A special feature in this year’s Index of U.S. Energy Security Risk is a look at trends in security of world oil production that take into account the reliability and diversity of crude oil supplies over time. It notes, for example, that about 55% of the world’s current oil output comes from countries Freedom House categorizes as “not free”—in other words, countries more likely to see political turmoil, join cartels, or use energy for geopolitical ends. This is a substantial risk that makes America’s resurgence in oil production all the more important, because it reduces our, and the world’s, exposure to unreliable sources of oil. (Refer to the report for more details.)

The U.S. Index and its companion, the International Energy Security Risk Index, are available on our website at www.energyxxi.org/energysecurity.